Regardless of the relative tepid motion within the crypto market since Bitcoin hit a new all-time excessive (ATH) in March, Bitcoin, Ethereum, and Solana have continued to high conventional property, together with Gold. This was highlighted in a current report that confirmed how crypto property have supplied the very best returns for some time now.

Bitcoin, Ethereum, And Solana Outperform Conventional Property

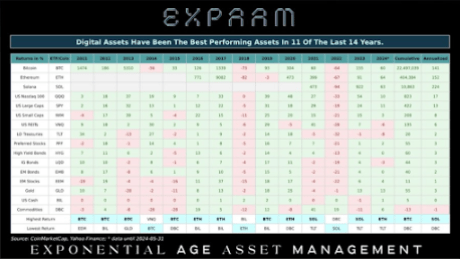

Raoul Pal, Co-Founding father of Exponential Age Asset Administration (EXPAAM), shared the crypto funding agency’s newest month-to-month replace, exhibiting annualized returns on all main property.

Associated Studying

Bitcoin, Ethereum, and Solana have topped conventional property with annualized returns of 141%, 152%, and 224%, respectively. For context, NDX, the very best main conventional asset, boasts an annualized return of 17%.

Because of this, these crypto property have been the best-performing property in 11 of the final 14 years. These digital property additionally look on track to outperform conventional property once more this 12 months, as they boast larger year-to-date (YTD) features. Information from CoinMarketCap exhibits that Bitcoin, Ethereum, and Solana at present have YTD features of over 67%, 66% and 70%, respectively.

Then again, Gold, the best-performing non-crypto asset this 12 months, has a YTD acquire of 13%. The NDX boasts a YTD acquire of 10%, whereas the SPY has recorded a YTD acquire of 11%. Curiously, whereas the volatility of crypto property has been criticized at instances, this has largely contributed to why they’ve continued outperforming conventional property.

The Director of International Macro at Constancy Investments, Jurrien Timmer, beforehand highlighted how Bitcoin has continued to report the very best risk-reward since 2020. He additionally alluded to Bitcoin’s excessive volatility, stating that Bitcoin’s large drawdowns have additionally include giant features. The identical also can mentioned about crypto tokens, particularly contemplating {that a} token like Solana, which dropped to as little as $10 in late 2022, is now buying and selling above $170.

Extra Positive aspects Forward For BTC, ETH, SOL

Bitcoin, Ethereum, and Solana are anticipated to report extra YTD features because the 12 months progresses, on condition that the crypto market is at present in a bull run. Latest developments within the crypto market additionally paint a bullish outlook for these crypto tokens. One is the elevated demand for the Spot Bitcoin ETFs. Information from Farside Traders confirmed that these funds recorded internet inflows of $886.6 million on June 4, their finest day since March.

Associated Studying

In the meantime, the Spot Ethereum ETFs are anticipated to start buying and selling by July. Crypto analysts like Michael van de Poppe predict these funds may spark a big rally for Ethereum and different altcoins. ‘Solana Summer season’ additionally appears to be on the horizon, with the crypto token exhibiting indicators of imminent parabolic upward development.

On the time of writing, Bitcoin has damaged above the $70,000 resistance degree and is buying and selling at round $71,000, up nearly 3% within the final 24 hours, in response to knowledge from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com