As bitcoin’s (BTC) value wilts, merchants on crypto trade Bitfinex reside as much as their popularity of being dip consumers, providing some hope to battered crypto bulls given their observe document of predicting market peaks and troughs.

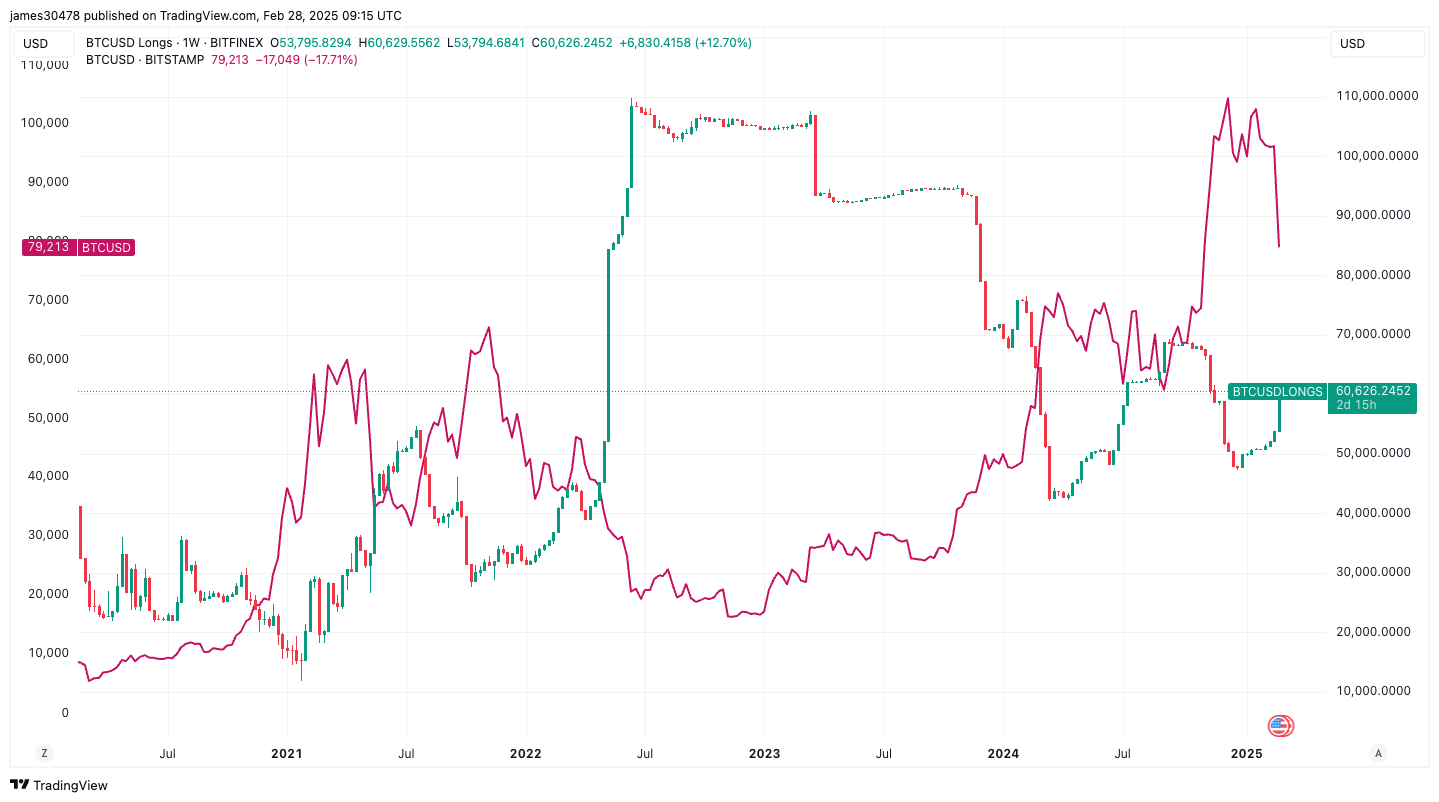

The variety of bitcoin purchased on Bitfinex with borrowed money, a guess that the BTC value will rise and go away the investor with a revenue as soon as they’ve repaid the mortgage, has risen to greater than 60,000 BTC from 50,773 this month. It is jumped 2% up to now 24 hours alone, based on knowledge from Coinglass and TradingView.

The rise in so-called margin lengthy positions is a vote of confidence within the largest cryptocurrency, which has misplaced greater than 20% this month and is on observe for its worst month-to-month efficiency since June 2022.

Bitfinex merchants are primarily whales — or holders of enormous quantities of bitcoin — who dabble with margin longs. They’re recognized for precisely signaling bitcoin tops and bottoms and have a tendency to build up throughout downtrends or rangebound markets, as they did in the course of final yr.

Taking a look at a five-year timeframe, margin longs have persistently elevated holdings throughout value swoons and decreased publicity close to market peaks. This sample was evident in the course of the 2021 and 2024 market tops.

Because the crypto market tumbles, crypto market sentiment is in a state of maximum concern, based on Coinglass’ Crypto Worry & Greed Index. Over the previous yr, the market has solely seen 4 days of maximum concern. It has been dominated by greed and excessive greed for over 230 days.